Recently, the crypto market has been buzzing with debates over the direction it’s taking. A focal point of these discussions is the Blast.io project, which has reportedly locked over $550 million in funds without withdrawal possibilities until February 2024 (source).

This article examines the Blast.io airdrop project, comparing it with traditional Ponzi schemes and addressing concerns raised by the crypto community.

Use my squad code 4DHSV and let’s navigate this journey together. Visit blast.io/4DHSV to get started.

Blast.io airdrop referral system

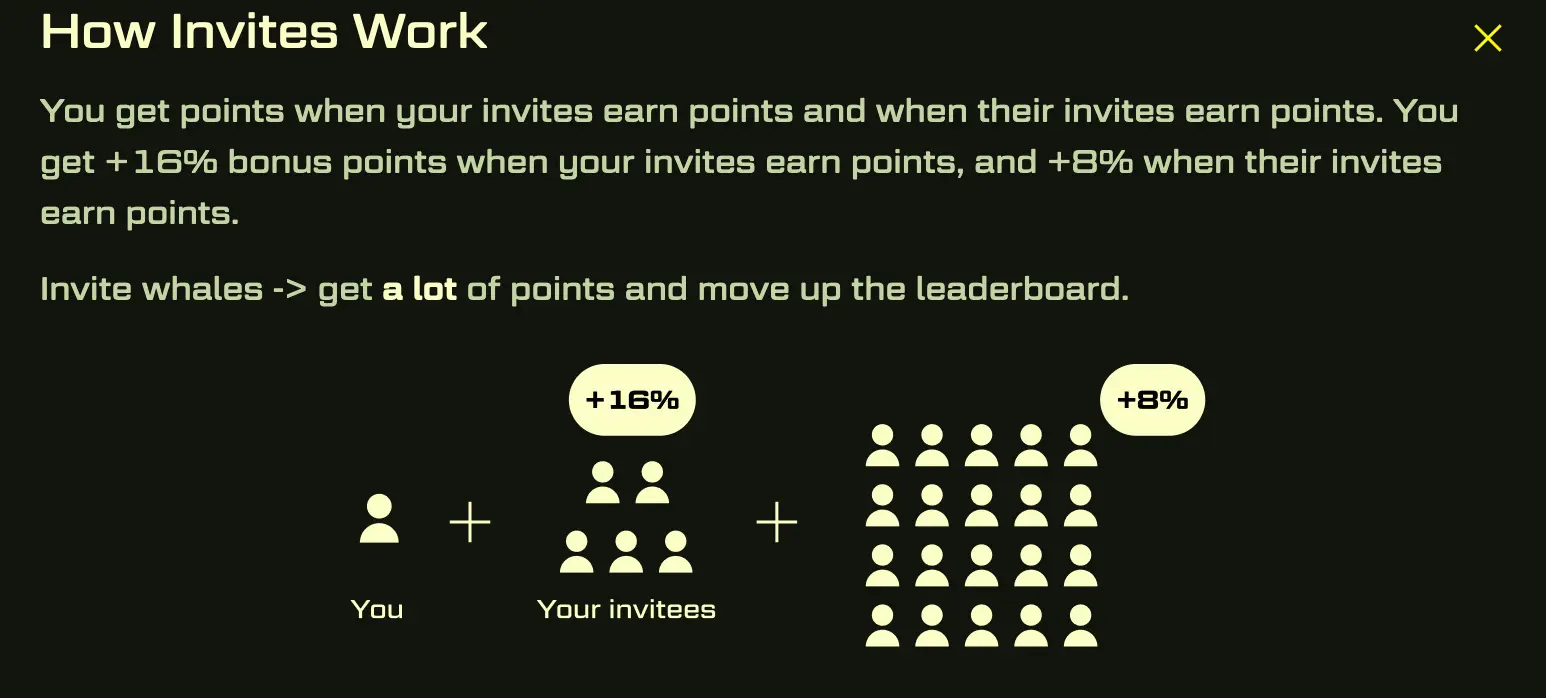

Blast’s referral system offers first-level referrals 16% points and second-level (those invited by first-level referrals) 8% points. This has sparked accusations of being a pyramid or MLM scheme. However, Blast innovates by:

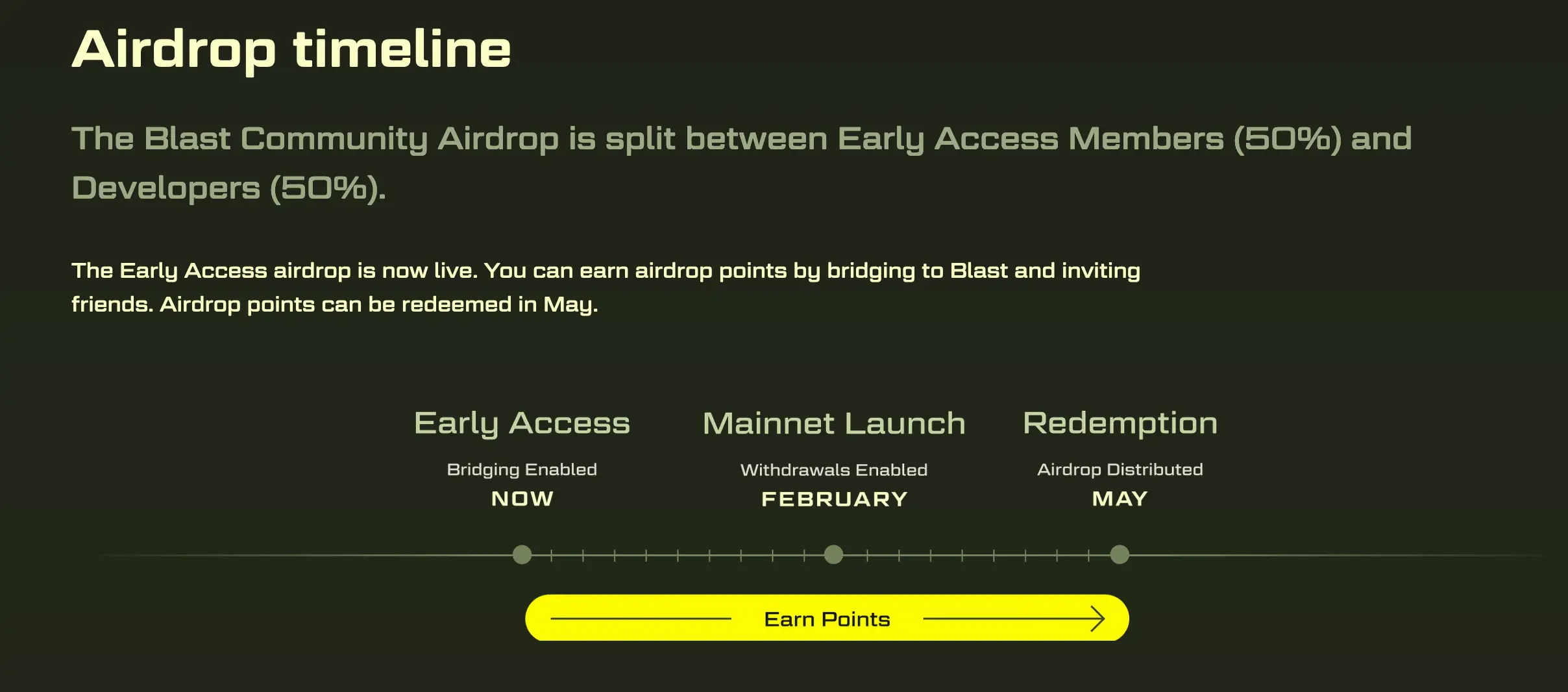

- Granting points, including those from referrals, until the token launch in May 2024.

- Planning to allocate a set percentage of token emissions to depositors.

- Summing up all participants’ points at the end of the accrual period (November 2023 – May 2024).

- Dividing the planned token distribution by the total points to determine the conversion rate of points to tokens.

For example, if 1 billion tokens are to be distributed among depositors who collectively earned 100 billion points, the conversion rate would be 0.01 points per token. This model contrasts with a Ponzi scheme, where the financial model collapses without new user influx.

Bonus: On this page, you can view which wallets have deposited funds and the amount of funds contributed to the Blast.io airdrop.

Earning Points by Inviting Users:

- Method: Invite other users to bridge to Blast.

- Rewards:

- 16% of points from direct invites (User A).

- 8% of points from indirect invites (User B invited by User A).

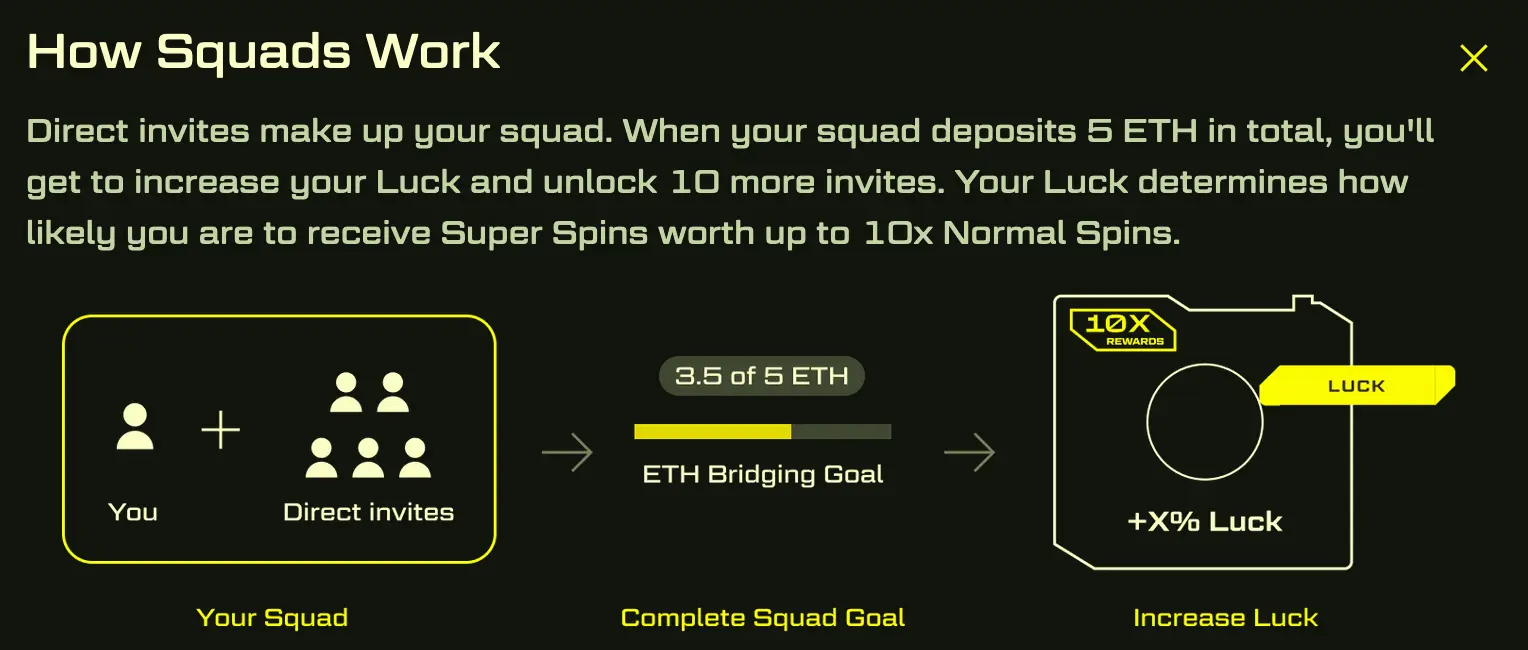

Obtaining Invite Codes

- Initial Access: Received after completing onboarding steps and bridging to Blast.

- Additional Invites: Unlocked by reaching squad goals.

Invites and Infinite Invite Code

- Unlocking New Invites: Achieved by reaching squad goals.

- Infinite Invite Code: Unlocked after your squad deposits 20 ETH.

Squad Goals and Rewards

- Objective: Reach certain milestones (e.g., depositing 20 ETH) with your squad.

- Rewards: Luck spins for you and up to 10 users you invited.

- Additional Benefit: Unlocking new invite codes and an infinite invite code after depositing 20 ETH with your squad.

Understanding Luck Spins and Luck Value

- Luck Spins: Do not directly earn points. They are awarded for reaching squad goals.

- Luck Value:

- Effect: Increases the chance of a super spin (2-10x normal spins).

- Permanence: Luck value is permanent and can only increase.

- Example: If current luck is 50%, it will increase if a luck spin results in 60% but will stay at 50% if the spin results in 40%.

Points Reward Structure

- Direct Invites (User A): 16% of points from their spins.

- Indirect Invites (User B): 8% of points from their spins.

Point Ranges from Spins

- Normal Spin Range: 1 – 11,000 points.

- Super Spin Range: 2x – 10x normal spin rewards.

- Influence of Luck: Increases chances of a super spin.

ETH Deposit to Spin Rate

- Rate: 1 spin per ETH per week.

- Calculation: 7 days / Amount of ETH = Days until next spin.

- Example: For 10 ETH, a spin is received approximately every 0.7 days (~16.8 hours or 1008 minutes).

Blast L2: Current Status and Design

At present, Blast L2 exists as an Ethereum mainnet contract, yet to unveil its Layer 2 functionalities. The contract is under the governance of a 3/5 multi-sig arrangement, with specified addresses holding control. Tokens sent to this contract remain locked until the planned mainnet launch in February 2024.

These addresses are used to manage, send, receive, or lock funds as part of the Blast L2 contract (each address is controller in the multi-sig governance of the contract):

- 0x59cDa1e234505D460c972e58452c0A6d8e14a5Ce

- 0xb7c719eB2649c1F03bFab68b0AAa35AD538a7cC8

- 0x1f97306039530ADB4173C3786e86fab5e6b90F41

- 0x6a356C0EA560f00127Adf5108fFAf503b9f1e11

- 0x46e31F27Df5047D7Fad9b1E8DFFe6C635cF6efAcF

Multisig 3/5 Without Time Lock

Blast uses a multisig 3/5 approach, common in Layer 2 solutions like Arbitrum, Optimism, and Polygon. The absence of a time lock allows the team to respond swiftly to emerging issues or hacking attempts.

Layer 2 (L2) Technology

Blast is built on the Optimism tech stack. The Base Chain by Coinbase operates on a similar stack. The team behind Blast, including the founder of Blur, has shown remarkable agility in improving user interfaces and shipping new features. With support from crypto minds at Paradigm (who assisted in Uniswap’s development), adapting the Optimism stack for income-generating tokens is feasible.

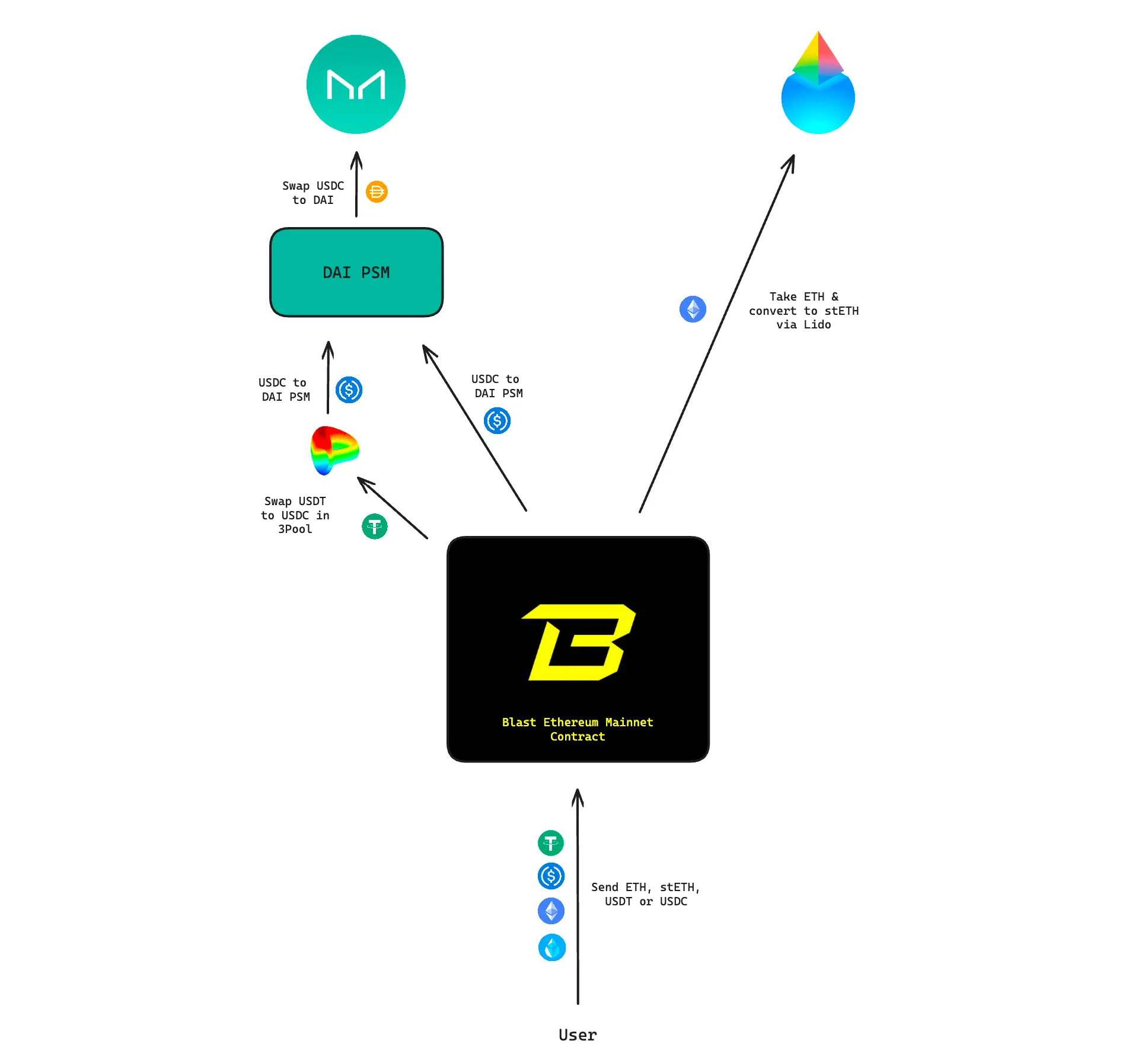

Original image from twitter thread of @asxn_r

Key Features of the Blast Ecosystem

The cornerstone of Blast’s ecosystem is its default yield offering on user assets. Users can send USDT, USDC, ETH, or stETH to the mainnet contract. Upon receipt, Blast converts these assets into yielding derivatives through various mechanisms.

Conversion Mechanisms:

- USDC: Swapped to DAI in the PSM at a 1:1 ratio and then placed in MakerDAO’s sDAI.

- USDT: Converted to USDC in Curve Finance’s 3Pool, following the same route as USDC.

- ETH: Deposited into Lido Finance for stETH conversion.

- stETH: Held within the contract.

Earning Yields on Stablecoins and ETH

Stablecoins like DAI can earn a ‘risk-free rate’ via MakerDAO’s sDAI contract, typically around 5%. ETH, when converted into Lido’s stETH, earns yield from Ethereum’s consensus and execution layer rewards, offering a lucrative option for ETH holders.

Incentives for Developers

A unique aspect of Blast is its support for smart contract developers. They can integrate Blast’s native yield capabilities into their applications. Additionally, Blast redistributes gas fee revenues back to the developers, allowing them to either retain these earnings or use them to subsidize gas fees for users.

Potential Blast.io Airdrop Earnings

The world of decentralized finance is abuzz with the rapid growth of the Blast mainnet contract, which has amassed a staggering $550M in Total Value Locked (TVL) within a mere four days.

This surge is attributed to participants eager to earn through the Blast L2 airdrop by accumulating points.

The airdrop is evenly split, with 50% going to developers and the other 50% to ‘Early Access Users’. The portion allocated to Early Access Users is further divided equally between those who deposit into Blast and those who stake Blur.

The TVL for both staking and deposits is in flux. The model does not account for the distribution of points, which is expected to follow a power law or Pareto’s principle, where 80% of the airdrop is likely to go to 20% of the users.

Mean Average Return on Capital

This analysis aims to determine the mean average return on capital. For instance, if $550M of TVL is placed into the Blast contract, it’s anticipated that this would yield $50M of BLAST tokens, given the specified Fully Diluted Valuation (FDV) and airdropped percentage. However, the actual distribution will vary based on the points distribution.

Sensitizing the Blast FDV and Airdrop Percentage

To calculate the mean return on capital, we adjust the Blast FDV and the percentage of the total supply that is airdropped. Our findings suggest that if the FDV lies between $2.25B and $3.75B and the airdrop percentage is between 15% and 25%, the three-month return on Blast deposits could range from 28% to 78%.

Comparing Returns from Blur Staking

Turning our attention to Blur staking, the analysis within the same FDV and airdrop range indicates that the mean return is significantly higher, ranging from 39% to 110%.

| Potential Blast.io Airdrop Earnings | |

|---|---|

| Blast L2 FDV (Millions) | $1000M |

| Community & Developer Allocation | 20% |

| Total Airdropped (Millions) | $200M |

| Developer Allocation | 50% |

| Developer Airdrop | $100M |

| User Allocation | 50% |

| User Airdrop | $100M |

| Blast Depositor Allocation of User Airdrop | 50% |

| BLUR Staker Allocation of User Airdrop | 50% |

| Blast Depositor Airdrop | $50M |

| BLUR Staker Airdrop | $50M |

| Blast TVL | $550M |

| Blur Staked | $214M |

| Estimated Airdrop per $ Deposited into Blast | $0.12 |

| Estimated Airdrop per $ of Staked Blur | $0.23 |

| Blast Deposit 3 Month Return | 12% |

| BLUR Staking 3 Month Return | 23% |

What Blast.io Founder ‘@PacmanBlur’ had to say about the Ponzi scheme allegations

“I’ve seen a number of misunderstandings about Blast spreading around. While many of these are humorous memes, it’s important to set the record straight on a few points:” – in his Twitter thread, he explained. Following are the key takeaways from this thread:

Blast’s Yield Source – Not a Ponzi Scheme:

The misconception that Blast is a Ponzi scheme stems from its seemingly high yield. However, this yield is derived from legitimate sources:

- Lido Yield: Comes from Ethereum’s Proof-of-Stake consensus mechanism, a fundamental part of Ethereum’s blockchain operations.

- MakerDAO Yield: Generated from on-chain T-Bills, which are U.S. government debt obligations, integral to the U.S. economy. These yields are sustainable and integral to both on-chain and off-chain economies. Blast’s innovation lies in making this yield accessible to all users, essentially democratizing high yield that was previously not as visible.

Paradigm’s Role – Technical, Not Strategic:

There’s a misconception about Paradigm’s involvement in Blast’s go-to-market (GTM) strategy. Paradigm, a research entity known for its contributions to projects like Uniswap and Blend, did not participate in Blast’s GTM.

- Their involvement is confined to technical consultation, particularly in Layer 2 (L2) design, which is their area of expertise. However, they have no say in Blast’s GTM decisions, although they have offered suggestions post-launch.

- This distinction is crucial to understand Paradigm’s role as a technical advisor rather than a strategic driver in Blast’s launch and operations.

Invite Rewards System – Community Building, Not Just Marketing:

The invite rewards system in Blast is sometimes misinterpreted as a mere marketing gimmick. However, it serves a more significant purpose in community building.

- Recognizing the value users bring by growing the platform through referrals, Blast’s invite system rewards users for contributing to the ecosystem.

- This mechanism is not unique to Blast and has been a longstanding approach in various platforms to encourage user engagement and expansion.

Understanding these nuances is key to dispelling the misinformation surrounding Blast.

Step-by-Step Guide to Joining Blast.io Airdrop

This guide outlines the necessary steps to participate in the Blast early access and airdrop program. Make sure to follow each step carefully and refer to the official Blast website for the most up-to-date information.

1. Visit the Blast Website

Start by navigating to the official Blast website.

2. Join Early Access

Click on the “Join Early Access” button.

3. Obtain an Invite Code

If you want to join my squad You can use my unlimited code 4DHSV (blast.io/4DHSV).

Or you can join their Discord community to find invite codes.

4. Enter the Invite Code

Once you have an invite code, enter it on the website to gain access to the platform.

5. Follow on Social Media

- Follow Blast’s official accounts on Twitter and Discord.

- Click on “check your airdrop” to proceed.

6. Connect Your Wallet

Connect your MetaMask or other supported wallets to the platform.

7. Bridge Your Assets

- Go to the Bridge section on the Blast platform.

- Transfer ETH or other supported tokens (USDC, USDT, DAI, stETH, WETH) from Ethereum to the Blast Layer 2 (L2) network.

- Ensure you have sufficient ETH or other tokens (which can be acquired from exchanges like Binance) for eligibility.

8. Understand Withdrawal Limitations

Be aware that tokens bridged to Blast can only be withdrawn in February, following the launch of the mainnet.

9. Earn Spins

- For every ETH deposited, you will earn one spin per week.

- Each spin unlocks a certain number of airdrop points.

10. Receive Referral Codes

- After completing your initial bridging, you will be given referral codes.

- Initially, only a limited number of codes will be provided.

11. Increase Earning Potential

The more you and your invited friends bridge, the more spins and potential earnings you accumulate.

12. Convert Points to Tokens

In May, all the airdrop points you’ve earned can be converted to Blast tokens.

Final Thoughts on Blast.io airdrop

Blast.io’s strategic approach and mechanisms appear to establish a robust foundation for a sustainable and community-driven project. The emphasis on developer incentives and the integration of native yield capabilities indicate an alignment with the broader movement towards decentralized finance (DeFi) ecosystems that prioritize user benefit and developer innovation.

The true test for Blast.io will be its ability to fulfill its promises and maintain the projected growth trajectory until the mainnet launch and beyond.

We’ll see what happens in May 2024.